What is Withholding tax in Pakistan? It’s a common question that people have in their minds. In simple terms, it is a form of income tax that people pay on the source of income.

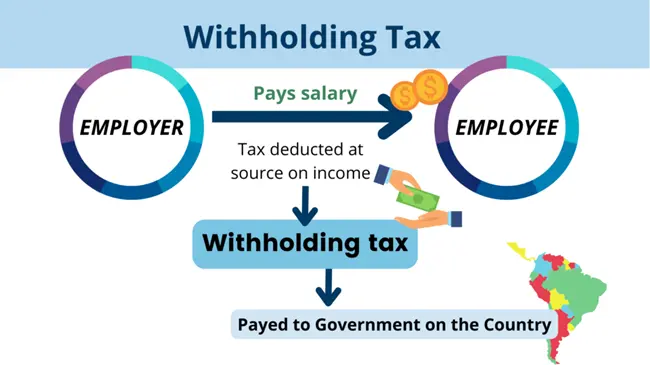

This means that when you receive a payment, such as a salary, the person or company making the payment (the payer) has to set aside a portion of that payment. Then he sends it directly to the government.

How Does WHT Work?

On salary, interest, or dividend, the payer (e.g., employer, bank)has to deduct a specific percentage of the payment as tax. The withheld amount is then sent to the government tax authority.

Moreover, when you file your annual income tax return, you have to calculate how much tax you have to pay on the basis of your total income.

As the employer (or other payer) has already been withholding a portion of your income for taxes, you can subtract that amount from the total tax you need to pay. This is called a credit.

Importance of Withholding Taxes in Pakistan

Withholding taxes is of great importance for the government, for example:

Major Source of Revenue

The withholding taxes constitute a big portion of the income of the federal government of Pakistan.

There is always one trustworthy source of income for the government that would generate cash at regular or specified intervals.

Regular Income for the Government

Unlike other taxes, withholding taxes mean a generation of steady income throughout the year.

This helps the government run its financial and other operations smoothly.

Ease for the Taxpayer

Instead of making a bulk payment at the end of the year, the taxpayers have their tax amount deducted gradually from their income.

So, it helps people and businesses bear their tax burdens easily.

Common Types of Withholding Taxes in Pakistan

| Type of Income | Withholding Tax Deductor |

| Employment Income | Employer |

| Interest Income | Bank or Financial Institution |

| Dividend Income | Company |

| Sales Tax | Depends on the transaction |

You can also check out the withholding tax rate in Pakistan tax rates through the FBR website.

Who manages withholding tax in Pakistan?

The Directorate General of Withholding Taxes, established in 2008, is a body that governs and regulates the withholding tax rules within Pakistan.

Withholding Taxes on Payments to Non-Residents

For the non-residents who derive an income in Pakistan, withholding tax is deducted at source on the following payments:

- Fees for technical services

- Royalties

- Dividends

- Interests

- Insurance premiums

- Fees for digital services, money transfers, card networks, payment gateways, and interbank financial telecommunication services

WHT Rates for Non-Residents

The general rate of WHT in Pakistan varies from 5% to 20% on different payments to non-residents. Each of these rates applies according to the nature of the payment and the state of residence of the non-resident.

However, here comes the twist: the tax treaties. In this case, if Pakistan has entered into a tax treaty with a non-resident country, it can reduce or even cancel the withholding tax sometimes.

That means that the non-resident will pay less or no tax from those types of income earned in Pakistan.

Things You Should Know About WHT

You must know these important points about WHT:

WHT for Non-ATL Taxpayers

If a taxpayer is not on the Active Taxpayers List (ATL), the WHT they pay might be increased by 100%.

WHT for Residents and Permanent Establishments

Residents and non-residents with a permanent establishment in Pakistan are subject to WHT on transactions like the sale of goods, contracts, and services.

Exemption Certificates

If you believe you shouldn’t be subject to WHT, you can apply for an exemption certificate.

Tax Year and Record-Keeping

The tax year in Pakistan runs from July to June. Make sure you have receipts and bills to support your tax claims.

Claiming Withholding Tax Refunds (Residents)

Residents who overpay withholding taxes can claim a refund at the end of the tax year by filing an income tax return. They also need to provide evidence of withholding tax deductions.