We helped 150+ Companies in their registration process

1000+ IT Startups Trust our Tax Services

Haq & Company is a leading tax consultancy firm providing expert advice on income and sales tax matters. Our team of highly qualified and experienced professionals is committed to helping clients navigate the complex tax landscape with ease and confidence.

We are aware of the complexity and legal requirements that come along with company registration in Pakistan.

From the right business structure to all the paperwork with SECP (Securities and Exchange Commission of Pakistan), we take all the hassle out of the process.

So, you can focus on what matters most i.e. growing your business.

Consultation Request a free consultation with our experts, and we will talk about your business needs.

To prepare the legal documentation we gather and file all the documents with SECP and other authorities.

Registration After the approval of the paperwork, your company is officially registered.

We offer after service support to keep your company compliant with local regulations.

A PVT LTD in Pakistan is a separate legal entity with limited liability for its shareholders. It requires a minimum of two shareholders, and shares are privately held, making it suitable for small to medium-sized businesses.

A single shareholder private limited corporation is known as an SMC. It is perfect for business owners who want to enjoy corporate perks but still maintain total control over their enterprise since it provides minimal liability.

An LLP in Pakistan combines features of both a partnership and a company. It provides limited liability protection to partners and is best suited for professional services firms or small businesses wanting flexibility in management.

A sole proprietorship is a business owned and controlled by a single individual. It is simple to establish, and as there is no legal separation between the owner and the company, the owner is fully liable for all debts and liabilities.

After your company name is approved, you need to submit these documents to the SECP:

We provide a range of income tax services, including tax planning, compliance, and representation before tax authorities. Our experts stay up-to-date with the latest tax laws and regulations to ensure our clients receive accurate and timely advice.

Our sales tax consultancy services include registration, compliance, and representation before tax authorities. We help clients understand their sales tax obligations and ensure they are compliant with all applicable regulations.

We assist clients in preparing for tax audits and represent them before tax authorities. Our experts have extensive experience in dealing with tax audits and can help clients minimize their tax liabilities.

In case of tax disputes, we assist clients in filing appeals and represent them before appellate authorities. We have a proven track record of successfully resolving tax disputes in favor of our clients.

If you want to register a new company in Pakistan directly, you have two options for submitting your application:

The first step for both methods is to get the proposed company name approved by the registrar.

Here’s how you can apply physically to get a company name:

Once the registrar approves your name, they will issue a name availability letter and reserve the name for 60 days.After receiving the letter, you can register with the company. For more details, you can refer to the Companies (Incorporation) Regulations, 2017.

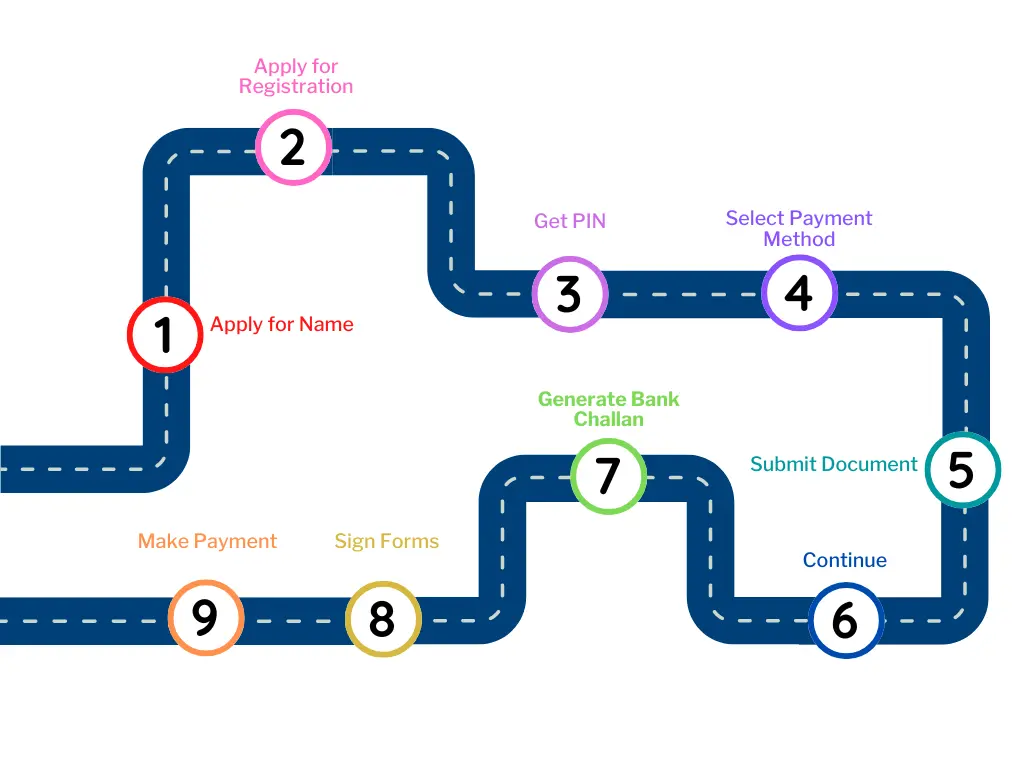

If you prefer online submission, here are the steps for how to register a company in Pakistan online

Before you can apply for a company name or registration online, you need a Personal Identification Number (PIN). Follow these steps:

You’ll receive a 4-digit PIN on your email and phone. This PIN will be used to electronically sign forms and documents.

Important Notes

If you choose the combined process (name reservation and incorporation), you can do both at the same time.

However, this option is not available for foreign companies or companies requiring prior approvals.

Here’s the step-by-step process:

After your company name is approved, you need to submit these documents to the SECP:

| Requirement | Details |

| Undertaking | Required in case of a security clearance issue. |

| Foreign Individual’s Documents | 5 copies of the individual’s CV, passport-sized photos, and personal details. |

| Foreign Company’s Documents | Company profile, list of directors, and certified copies of relevant documents. |

After submitting the documents and paying the fee, the SECP processes your application within four hours. The certificate of incorporation will be emailed to you.

Your company’s data will be sent to the FBR for NTN registration. The FBR will send the NTN login details to the Chief Executive’s email and phone.

The cost of registering a company depends upon the type of company. To get further details, talk to an expert.

You must be a registered company to run your business in Pakistan according to the SECP Act 1997,

You Make Strategies to Grow Your Business & We Take Hassle of Your Company Registration in Pakistan

Company registration in Pakistan is an important step to make your business official and protect your personal assets.

With Waystax, you can be confident that the process will be easy, follow all legal requirements, and fit your specific business needs.

Here are the methods of registration of a company in Pakistan in FBR

It is open only to individuals.

Requirement: Phone number( registered with your NIC), email, bank account proof, and business proof if required, paid utility bills of business location ( not older than last 3 months.

For individuals, AOPs, and companies.Requirement: CNICs, deed of partnership (AOP), incorporation certificate (company), authorization letter, proof of bank account, business proof, if applicable.